The account set up method is not difficult, and there aren't any further fees to get going. Not merely could it be among the best self-directed IRAs, but it surely’s the top low-cost self-directed IRA all-around.

You will discover other solutions to open an IRA and save for retirement. You may decide to rent a fiscal advisor to system out your retirement tactic, and they could open an IRA and regulate the account in your case, even though this can be costly. Financial institutions also offer IRAs, Though they are generally limited to Keeping certificates of deposit (CDs).

Of course, you can preserve multiple IRAs throughout diverse brokers. Some investors do this to entry specific investment possibilities or take full advantage of distinct brokers' characteristics.

In contrast, whenever you click a Microsoft-offered advert that appears on DuckDuckGo, Microsoft Advertising won't associate your ad-simply click habits that has a user profile. In addition it doesn't keep or share that data aside from for accounting applications.

Roth IRA contributions are issue to money limits, previously mentioned which your power to lead starts to period out and eventually gets limited totally.

six. Log in in your new IRA account and make sure that your resources are invested when you drive. For those who skip this phase, your money will possible stay sitting down inside of a settlement account that earns little fascination and gained’t be working for yourself.

All of our written content is authored by really capable gurus and edited by material gurus, who ensure almost everything we publish is aim, exact and reliable. Our reporters and editors focus on the points individuals treatment about most — how to save lots of for retirement, understanding the types check my reference of accounts, how to decide on investments and a lot more — in order to really feel self-assured when planning on your potential.

Buyer assist might be important, but desires vary by investor. Some brokers offer you 24/seven telephone aid with focused retirement specialists, while others mostly depend upon chat and electronic mail.

Participation entails sure risks and does not assure that you'll generate income. Vanguard Brokerage maintains an economic fascination in Totally Compensated Lending software financial loans and earns earnings in reference to this sort of financial loans.

Wealth preservation usually means defending yourself and your heirs from getting rid of all you have got worked to achieve and conserve. Situations are distinctive for everyone, and every unique or spouse and children's predicament is unique, so some wealth preservation techniques may match very well for yourself. In distinction, Other folks may not be the ideal in good shape. Nonetheless, your assets are value shielding!

You need to only spend money on assets that you've a sound idea of and possess researched beforehand.

At that point, Microsoft Advertising will use your complete IP handle and user-agent string to make sure that it could possibly correctly approach the ad click on and cost the advertiser.

Our study of your brokerage space concerned intensive screening of 21 distinctive on the web brokerage platforms. We regarded more than one hundred capabilities and variables and collected thousands of different data factors.

For A lot of people, which could indicate shelling out taxes in a reduce price in retirement versus the tax amount in the course of your peak earning yrs.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Karyn Parsons Then & Now!

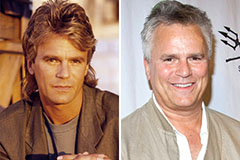

Karyn Parsons Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!